Wonderful Introduction:

If the sea loses the rolling waves, it will lose its majesty; if the desert loses the dancing of flying sand, it will lose its magnificence; if life loses its real journey, it will lose its meaning.

Hello everyone, today Avatrade Aihua Foreign Exchange will bring you "[Aihua Foreign Exchange Platform]: CPI may cool down unexpectedly, the White House refutes the rumor that the candidate for the Federal Reserve Chairman." Hope it will be helpful to you! The original content is as follows:

On June 11, early trading in Asia on Wednesday, Beijing time, the US dollar index hovered around 99.03. On Tuesday, as Sino-US trade negotiations entered the second day, the US dollar index fluctuated around the 99 mark and finally closed up 0.04% to 99.046. U.S. Treasury yields fell first and then rose, with the benchmark 10-year U.S. Treasury yields closed at 4.48%, and the 2-year U.S. Treasury yields closed at 4.033%. Spot gold once approached the $3300 mark during the session, and then continued to rise, reaching a high of $3349.1/ounce. The US market gave up all the gains in the day and finally closed down 0.09% to close at $3322.6/ounce; spot silver fell from a record high and finally closed down 0.63% to $36.53/ounce. International crude oil remained near its highs in the past seven weeks. WTI crude oil showed an inverted V-shaped trend, once standing above the $65 mark, then took a sharp turn and fell, finally closing down 0.14% to $64.47/barrel; Brent crude oil closed down 0.09% to $66.72/barrel.

Analysis of major currencies

Dollar Index: As of press time, the US dollar index hovers around 99.03. The dollar index fell back as the chief negotiator of the United States (US) and China held trade talks in London, and investors were anxious. The dollar has been hit hard in the past few months as new economic policies and unstable tariff announcements implemented by U.S. President Donald Trump has skeptical of the credibility of the dollar. Technically, if the U.S. dollar index successfully closes above the 99.20 level, it will move towards the resistance level in the 100.20–100.40 range.

Analysis of gold and crude oil market trends

1) Analysis of gold market trends

Which trading on Wednesday, gold trading around 3334.09. The current gold market is under the influence of multiple factors. Geopolitical tensions and global economic slowdown provide solid bottom support for gold prices, but optimistic expectations of Sino-US trade negotiations and the strengthening of the US dollar limit its upward space. In the short term, gold prices may fluctuate in the range of 3250 to 3350 US dollars per ounce, waiting for further clarity in CPI data and trade negotiations. In the long run, if global economic uncertainty continues to intensify, the attractiveness of gold as a safe-haven asset will be further highlighted, but the easing of the trade situation may put pressure on it in the short term.

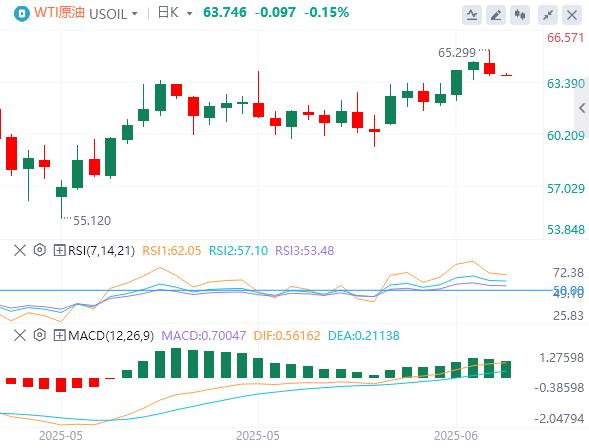

2) Analysis of crude oil market trends

On Wednesday, crude oil trading around 63.74. Oil prices fell on Tuesday but remained near a seven-week high, as markets waited for the outcome of trade negotiations to guide the direction. Analysts say a trade deal between the two world's largest economies could support global economic growth and increase oil demand, boosting oil prices.

Forex market trading reminder on June 11, 2025

①20:30U.S. May unseasoned CPI annual rate

②20:30U.S. May after seasonal adjustment CPI monthly rate

③20:30U.S. May after seasonal adjustment core CPI monthly rate

④20:30U.S. May unseasoned core CPI annual rate

⑤22:30U.S. to June 6th EIA crude oil inventories

⑥22:30U.S. to June 6thWeekly EIA Cushing crude oil inventories

⑦22:30 EIA strategic oil reserve inventories in the week from the United States to June 6

⑧The next day, 01:00 US to June 11 10-year Treasury bond auction-winning interest rate

⑨The next day, 01:00 US to June 11 10-year Treasury bond auction-winning multiple

The above content is about "[Ihua Foreign Exchange Platform]: CPI may unexpectedly cool down, the White House refutes the rumor of the candidate for the Federal Reserve Chairman" and is carefully www.avaforexcn.compiled by the Avatrade Foreign Exchange editor. I hope it will be helpful to your transaction! Thanks for the support!

Due to the author's limited ability and time constraints, some content in the article still needs to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues: